Monday, August 31, 2020

More on: Ed George at 70 Looks Better than I Looked at 45

I may have jumped the gun. I had assumed that the plan was to stay 2020 but going virtual. Maybe not. Maybe 2021 physical. We'll see. Keep checking the link.

Ed George at 70 Looks Better than I Looked at 45

Check him out: http://jh-cai.com/edgeorge70/. So unfair. Nevertheless I hope you will put my esteemed colleague's 70th birthday conference on your calendar and join the online festivities. His contributions are diverse and powerful. In many respects his work defines modern applied Bayesian analysis, as well as the modern interface of statistics and machine learning. I am immensely grateful for his leadership in research, in seminars, at dinners, and much more. His inspirational positivity runs through it all.

Monday, August 24, 2020

Big Data: Updated Historical Note and New BBC Podcast

On High-Dimensional, Non-Linear, Non-Gaussian Continuous-Time Likelihood Evaluation

Tired of trying to beat the particle filter into submission? Life has gotten a lot easier, at least for evaluating DSGE model likelihoods in continuous time. See the concluding section of the new and insightful survey, "Estimating DSGE Models: Recent Advances and Future Challenges" by Fernández-Villaverde and Guerrón-Quintana, which echoes section 5.1 of "Financial Frictions and the Wealth Distribution", by Fernández-Villaverde, Hurtado and Nuño (FVHN). FVHN show how to take advantage of the mathematical structure of a continuous-time DSGE model to evaluate its associated likelihood with almost no computational effort. In particular, solution of the Kolmogorov forward equation (the key to likelihood evaluation; see Lo (1987)) simply amounts to transposing and inverting a sparse matrix already computed when solving the model, which makes likelihood evaluation trivial and lightening-fast.

Friday, August 14, 2020

The HAC Emperor Has No Clothes: Part 3

A new paper by Dick Baillie, George Kapetanios and Kun Ho Kim, "Practical Approaches to Achieve Robust Inference in Time Series Regressions," brings all this into even sharper focus. Their beautiful Figure 1, reproduced below, says it all. The black dot is feasible GLS; the reds and blues are the standard nonparametric competitors. Presumably the paper will be posted soon. A related much earlier paper is here.

Tuesday, August 11, 2020

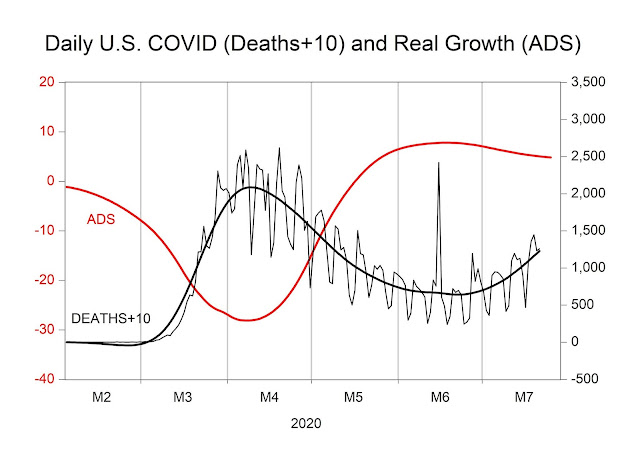

COVID, the Business Cycle, and the Stock Market

Monday, August 10, 2020

Density Forecasts and Density Realizations

Check out the interesting new paper below. Of course I am a fan of predictive densities (e.g., GDP fan charts). Usually I compare them to the "realization" (e.g., "published GDP"). But of course, as the authors emphasize, the realization is just a point estimate of true GDP, whereas in reality true GDP is itself uncertain and has its own density, which can be estimated (maybe...) from revisions. Very interesting. I wonder, for example, how predictive density assessments based on the probability integral transform (e.g., here) would need to be modified to account for uncertainty in the measured realization.

By: Galvao, Ana Beatriz (University of Warwick); Mitchell, James (University of Warwick) Abstract: GDP is measured with error. But data uncertainty is rarely communicated quantitatively in real-time. An exception are the fan charts for historical GDP growth published by the Bank of England. To assess how well understood data uncertainty is, we first evaluate the accuracy of the historical fan charts and compare them with models of past revisions data. Secondly, to gauge perceptions of GDP data uncertainty across a wider set of experts, we conduct a new online survey. Our results call for greater communication of data uncertainties, to anchor dispersed expectations of data uncertainty. But they suggest that transitory data uncertainties can be adequately quantified, even without judgement, using past revisions data. Keywords: data revisions; fan charts; expectations survey; backcasts; density forecast calibration JEL: C53 E32 Date: 2020 URL: http://d.repec.org/n?u=RePEc:wrk:wrkemf:35&r=ets

Tuesday, August 4, 2020

Carlo Bianchi RIP

Very sad to report that Carlo Bianchi, legendary organizer and host of the Bertinoro econometrics summer school (formally the CIDE Summer School of Econometrics) passed away today. His was an absolutely unique and endearing personage.

Whether or not you knew him, check out the testimonials at his retirement a few years ago:

https://carlobianchiandcide.wordpress.com/2015/11/03/20-years-of-the-cide-summer-school-of-econometrics/

Whether or not you knew him, check out the testimonials at his retirement a few years ago:

https://carlobianchiandcide.wordpress.com/2015/11/03/20-years-of-the-cide-summer-school-of-econometrics/

Saturday, August 1, 2020

2020 Arnold Zellner Award to Wayne Gao

Absolutely delighted to help spread the word that my young colleague Wayne Gao has won the 2020 Arnold Zellner Thesis Award in Econometrics and Statistics, for his Yale University dissertation "Essays in Network and Panel Modeling." The Zellner Award is given annually for the best Ph.D. thesis dealing with an applied problem in Business and Economic Statistics. It is intended to recognize outstanding work by promising young researchers in the field.

Check out the past recipients below. The list reads like a who's who of the past 25 years!

2019

Max Tabord-Meehan for the Northwestern University thesis "Essays in Econometrics".

Honorable Mention:

Vishal Kamat for the Northwestern University thesis "Essays in Microeconometrics".

Vira Semenova for the Massachusetts Institute of Technology thesis “Essays in Econometrics and Machine Learning”.

Zifeng Zhao for the University of Wisconsin-Madison thesis "Modeling Time Series via Copula and Extreme Value Theory”.

2018

Recipient:

Laura Liu for the University of Pennsylvania thesis "Point and Density Forecasts in Panel Data Models".

Honorable Mention:

Daniel R. Kowal for the Cornell University thesis "Bayesian Methods for Functional and Time Series Data".

2017

Recipient:

Rogier Quaedvlieg, for Maastricht University School of Business and Economics thesis "Risk and Uncertainty".

Geert Mesters for the Vrije University thesis "Essays on Nonlinear Panel Time Series Models".

Honorable Mentions:

Mingli Chen for the Boston University thesis "Research Related to High-Dimensional Econometrics".

2016

Recipient:

Pedro H. C. Sant'Anna, for the Universidad Carlos III de Madrid thesis "Essays on Duration and Count Data Models".

2015

Recipient:

Tim Christensen, for the Yale University thesis "Essays in Nonparametric Econometrics".

Honorable Mentions:

Rasmus Varneskov, for the Aarhus University thesis "Econometric Analysis of Volatility in Financial Additive Noise Models."

Dong Hwan Oh, for the Duke University thesis, "Copulas for High Dimensions: Models, Estimation, Inference, and Applications."

2014

Recipient:

Joachim Freyberger, for the Northwestern University thesis "Essays on Models with Endogeneity."

Honorable mentions:

Brendan Kline, for the Northwestern University thesis "Essays on the Econometrics of Games"

SeoJeong Lee, for the University of Wisconsin--Madison thesis "Misspecification-Robust Bootstrap for Moment Condition Models"

Minjing Tao, for the University of Wisconsin--Madison thesis "Large Volatility Matrix Inference Based on High-frequency Financial Data"

2013

Recipient:

Xin Tong, for the Princeton University thesis, "Learning with Asymmetry, High Dimension and Social Networks"

Honorable Mention:

Rob Hall, for the Carnegie Mellon University thesis, "New Statistical Applications for Differential Privacy"

2012

Recipient:

Alex Torgovitsky, for the Yale University thesis, "Essays in Econometric Theory."

Honorable Mention:

Zhipeng Liao, for the Yale University thesis, "Shrinkage Methods for Automated Econometric Model Determination."

2011

Recipient:

Kirill Evdokimov, for the Yale University thesis "Essays on Nonparametric and Semiparametric Econometric Models."

Honorable Mention:

Xu Cheng (2010 dissertation from Yale University) and Bryan Kelly (2010 dissertation from New York University)

2010

Co-Recipients:

Francesco Bianchi, for the Princeton thesis "Three Essays in Macroeconometrics," (PDF file).

Roopesh Ranjan, for the University of Washington thesis "Combining and Evaluating Probabilistic Forecasts," (PDF file).

2009

Recipient:

Amanda Ellen Kowalski, for the MIT thesis "Essays on Medical Care Using Semiparametric and Structural Econometrics" (PDF file, approx 1.02 Meg).

Honorable Mention:

Xun Tang, for the Northwestern University thesis "Essays in Empirical Auctions and Partially Identified Econometric Models," (PDF file, approx 1.23 Meg).

2008

Recipient:

Victor Todorov, for the Duke thesis "Jump Processes in Finance: Modeling, Simulation, Inference, and Pricings" (PDF file, approx 1.8 Meg).

Honorable Mention:

Andriy Norets, for the University of Iowa thesis "Bayesian Inference for Dynamically Discrete Choice Models".

2007

Recipient:

Panle Jia, for the Yale thesis "Entry and Competition in the Retail and Service Industries" (PDF file, approx 740 KB).

Honorable Mention:

Azeem M. Shaikh, for the Stanford University thesis, "Inference for Partially Identified Econometric Models," (PDF file, approx 980 KB).

2006

Recipient:

Philipp Schmidt-Dengler, for the Yale thesis "Empirical Analysis of Dynamic Models With Multiple Agents" (PDF file, approx 741 KB).

Honorable Mentions:

Zhongjun Qu for the Boston University thesis "Essays on Structural Change, Long Memory and Cointegration," (PDF file, approx 2.9 Meg).

Stephen P. Ryan for the Duke University thesis "Environmental Regulation in a Concentrated Industry" (PDF file, approx 1.0 Meg).

2005

Recipient:

Motohiro Yogo for the Harvard thesis "Essays on Consumption and Expected Returns" (PDF file, approx 1.0 Meg).

Honorable Mentions:

Morten Ø. Nielsen, for the University of Aarhus (Denmark) thesis, "Multivariate Fractional Integration and Cointegration," (PDF file, approx 2.2 Meg).

Giorgio E. Primiceri, for the Princeton University thesis, "The Effect of Stabilization Policy on U.S. Postwar Business Cycle Fluctuations" (PDF file, approx 1.5 Meg).

2004

Recipient:

Francesca Molinari for the Northwestern University thesis "Contaminated, Corrupted and Missing Data" (PDF file, approx 1.2 Meg).

Honorable Mentions:

Rebecca Hellerstein, for the University of California, Berkely thesis, "Empirical Essays on Vertical Contracts, Exchange Rates, and Monetary Policy," (PDF file, approx 550K).

Andrew Patton, for the University of California, San Diego thesis, "Applications of Copula Theory in Financial Econometrics," (PDF file, approx 1.5 Meg).

2003

Recipient:

Jin Gyo Kim for the University of Toronto thesis "Three Essays on Bayesian Choice Models" (PDF file, approx 4.3 Meg).

2002

Recipient:

Arie Beresteau for the Northwestern University thesis "Nonparametric Estimation of Supermodular Regression Functions with Applications to the Telecommunications Industry" (PDF file, approx 950K).

Honorable Mention:

Govert E. Bijwaard for the Free University (Amsterdam) thesis "Rank Estimation of Duration Models" (PDF file, approx 893K).

2001

Co-Recipients:

Mikhail Chernov for the Pennsylvania State University thesis "Essays in Financial Econometrics", available in PDF format, (approx 1.45 Meg).

Monika Piazzesi for the Stanford University thesis "Essays in Monitary Policy and Asset Pricing", available in PDF format, (approx 854K).

2000

Recipient:

Elie T. Tamer, for the Northwestern University thesis "Studies in Incomplete Econometric Models", which includes material from the following papers: "Incomplete Simultaneous Discrete Response Model with Multiple Equilibria," available in PDF format (approx 4.93 Meg) and "Inference on Regressions with Interval Data on a Regressor or Outcome," available in PDF format (approx 258K).

Honorable Mentions:

Alberto Abadie, for the MIT thesis "Semiparametric Instrumental Variable Methods for Causal Response Models," available in PostScript format (approx 816K).

Han Hong, for the Stanford University thesis "Equilibrium and Econometric Model of Ascending Auctions," available in PDF format (approx 909K).

1999

Co-Recipients:

Qiang Dai, for the Stanford University thesis "Specification Analysis of Affine Term Structure Models," available in PostScript (approx 594K) and PDF (approx 874K) formats.

Keisuke Hirano, for the Harvard University thesis "Essays on the Econometric Analysis of Panel Data," available on his research papers site.

1998

Recipient:

Patrick L. Bajari, for the University of Minnesota thesis "The First Price Sealed Bid Auction with Asymmetric Bidders: Theory with Applications."

Honorable Mentions:

Tong Li, for the University of Southern California thesis "Affiliated Private Values in OCS Wildcat Auctions,"

Ahmet K. Tahmiscioglu, for the University of Southern California thesis "A Bayesian Analysis of Pooling Cross-Section and Time Series Data: An Investigation of Company Investment Behavior."

1997

Recipient:

Jeffrey Currie, for the University of Chicago thesis "The Geographic Extent of the Market: Theory and Application to U.S. Petroleum Markets."

Honorable Mentions:

Jason Abrevaya, for the MIT thesis "Semiparametric Estimation Methods for Nonlinear Panel Data Models and Mismeasured Dependent Variables,"

Stephen Gray, for the Stanford thesis "Essays in Financial Economics."

1996

Recipient:

Ekaterina Kyriazidou, for the Northwestern University thesis "Essays in Estimation and Testing of Econometric Models." available in PDF format (approx 1.22 Meg).

Honorable Mention:

Graham Elliot, for the Harvard University thesis "Application of Local to Unity Asymptotic Theory to Time Series Regression."

1995

Recipient:

Marjorie Rosenberg, for the University of Michigan thesis "A Hierarchical Bayesian Model of the Rate of Non-Acceptable In-patient Hospital Utilization.", which led to the paper "A Statistical Control Model for Utilization Management Programs", available in PDF format.

Honorable Mention:

Phillip Braun, for the University of Chicago thesis "Asset Pricing and Capital Investment."

1994

Recipient:

Geert Bekaert, for the Northwestern University thesis "Empirical Analysis of Foreign Exchange Markets: General Equilibrium Perspectives."

Honorable Mention:

Yacine Aït-Sahalia, for the MIT thesis "Nonparametric Functional Estimation with Applications to Financial Models," which includes material from the following papers: "Nonparametric Pricing of Interest Rate Derivative Structures," available in PDF format (approx 1.66 Meg) and "Testing Continuous Time Models of the Spot Interest Rate" available in PDF format (approx 1.66 Meg)

Check out the past recipients below. The list reads like a who's who of the past 25 years!

2019

Max Tabord-Meehan for the Northwestern University thesis "Essays in Econometrics".

Honorable Mention:

Vishal Kamat for the Northwestern University thesis "Essays in Microeconometrics".

Vira Semenova for the Massachusetts Institute of Technology thesis “Essays in Econometrics and Machine Learning”.

Zifeng Zhao for the University of Wisconsin-Madison thesis "Modeling Time Series via Copula and Extreme Value Theory”.

2018

Recipient:

Laura Liu for the University of Pennsylvania thesis "Point and Density Forecasts in Panel Data Models".

Honorable Mention:

Daniel R. Kowal for the Cornell University thesis "Bayesian Methods for Functional and Time Series Data".

2017

Recipient:

Rogier Quaedvlieg, for Maastricht University School of Business and Economics thesis "Risk and Uncertainty".

Geert Mesters for the Vrije University thesis "Essays on Nonlinear Panel Time Series Models".

Honorable Mentions:

Mingli Chen for the Boston University thesis "Research Related to High-Dimensional Econometrics".

2016

Recipient:

Pedro H. C. Sant'Anna, for the Universidad Carlos III de Madrid thesis "Essays on Duration and Count Data Models".

2015

Recipient:

Tim Christensen, for the Yale University thesis "Essays in Nonparametric Econometrics".

Honorable Mentions:

Rasmus Varneskov, for the Aarhus University thesis "Econometric Analysis of Volatility in Financial Additive Noise Models."

Dong Hwan Oh, for the Duke University thesis, "Copulas for High Dimensions: Models, Estimation, Inference, and Applications."

2014

Recipient:

Joachim Freyberger, for the Northwestern University thesis "Essays on Models with Endogeneity."

Honorable mentions:

Brendan Kline, for the Northwestern University thesis "Essays on the Econometrics of Games"

SeoJeong Lee, for the University of Wisconsin--Madison thesis "Misspecification-Robust Bootstrap for Moment Condition Models"

Minjing Tao, for the University of Wisconsin--Madison thesis "Large Volatility Matrix Inference Based on High-frequency Financial Data"

2013

Recipient:

Xin Tong, for the Princeton University thesis, "Learning with Asymmetry, High Dimension and Social Networks"

Honorable Mention:

Rob Hall, for the Carnegie Mellon University thesis, "New Statistical Applications for Differential Privacy"

2012

Recipient:

Alex Torgovitsky, for the Yale University thesis, "Essays in Econometric Theory."

Honorable Mention:

Zhipeng Liao, for the Yale University thesis, "Shrinkage Methods for Automated Econometric Model Determination."

2011

Recipient:

Kirill Evdokimov, for the Yale University thesis "Essays on Nonparametric and Semiparametric Econometric Models."

Honorable Mention:

Xu Cheng (2010 dissertation from Yale University) and Bryan Kelly (2010 dissertation from New York University)

2010

Co-Recipients:

Francesco Bianchi, for the Princeton thesis "Three Essays in Macroeconometrics," (PDF file).

Roopesh Ranjan, for the University of Washington thesis "Combining and Evaluating Probabilistic Forecasts," (PDF file).

2009

Recipient:

Amanda Ellen Kowalski, for the MIT thesis "Essays on Medical Care Using Semiparametric and Structural Econometrics" (PDF file, approx 1.02 Meg).

Honorable Mention:

Xun Tang, for the Northwestern University thesis "Essays in Empirical Auctions and Partially Identified Econometric Models," (PDF file, approx 1.23 Meg).

2008

Recipient:

Victor Todorov, for the Duke thesis "Jump Processes in Finance: Modeling, Simulation, Inference, and Pricings" (PDF file, approx 1.8 Meg).

Honorable Mention:

Andriy Norets, for the University of Iowa thesis "Bayesian Inference for Dynamically Discrete Choice Models".

2007

Recipient:

Panle Jia, for the Yale thesis "Entry and Competition in the Retail and Service Industries" (PDF file, approx 740 KB).

Honorable Mention:

Azeem M. Shaikh, for the Stanford University thesis, "Inference for Partially Identified Econometric Models," (PDF file, approx 980 KB).

2006

Recipient:

Philipp Schmidt-Dengler, for the Yale thesis "Empirical Analysis of Dynamic Models With Multiple Agents" (PDF file, approx 741 KB).

Honorable Mentions:

Zhongjun Qu for the Boston University thesis "Essays on Structural Change, Long Memory and Cointegration," (PDF file, approx 2.9 Meg).

Stephen P. Ryan for the Duke University thesis "Environmental Regulation in a Concentrated Industry" (PDF file, approx 1.0 Meg).

2005

Recipient:

Motohiro Yogo for the Harvard thesis "Essays on Consumption and Expected Returns" (PDF file, approx 1.0 Meg).

Honorable Mentions:

Morten Ø. Nielsen, for the University of Aarhus (Denmark) thesis, "Multivariate Fractional Integration and Cointegration," (PDF file, approx 2.2 Meg).

Giorgio E. Primiceri, for the Princeton University thesis, "The Effect of Stabilization Policy on U.S. Postwar Business Cycle Fluctuations" (PDF file, approx 1.5 Meg).

2004

Recipient:

Francesca Molinari for the Northwestern University thesis "Contaminated, Corrupted and Missing Data" (PDF file, approx 1.2 Meg).

Honorable Mentions:

Rebecca Hellerstein, for the University of California, Berkely thesis, "Empirical Essays on Vertical Contracts, Exchange Rates, and Monetary Policy," (PDF file, approx 550K).

Andrew Patton, for the University of California, San Diego thesis, "Applications of Copula Theory in Financial Econometrics," (PDF file, approx 1.5 Meg).

2003

Recipient:

Jin Gyo Kim for the University of Toronto thesis "Three Essays on Bayesian Choice Models" (PDF file, approx 4.3 Meg).

2002

Recipient:

Arie Beresteau for the Northwestern University thesis "Nonparametric Estimation of Supermodular Regression Functions with Applications to the Telecommunications Industry" (PDF file, approx 950K).

Honorable Mention:

Govert E. Bijwaard for the Free University (Amsterdam) thesis "Rank Estimation of Duration Models" (PDF file, approx 893K).

2001

Co-Recipients:

Mikhail Chernov for the Pennsylvania State University thesis "Essays in Financial Econometrics", available in PDF format, (approx 1.45 Meg).

Monika Piazzesi for the Stanford University thesis "Essays in Monitary Policy and Asset Pricing", available in PDF format, (approx 854K).

2000

Recipient:

Elie T. Tamer, for the Northwestern University thesis "Studies in Incomplete Econometric Models", which includes material from the following papers: "Incomplete Simultaneous Discrete Response Model with Multiple Equilibria," available in PDF format (approx 4.93 Meg) and "Inference on Regressions with Interval Data on a Regressor or Outcome," available in PDF format (approx 258K).

Honorable Mentions:

Alberto Abadie, for the MIT thesis "Semiparametric Instrumental Variable Methods for Causal Response Models," available in PostScript format (approx 816K).

Han Hong, for the Stanford University thesis "Equilibrium and Econometric Model of Ascending Auctions," available in PDF format (approx 909K).

1999

Co-Recipients:

Qiang Dai, for the Stanford University thesis "Specification Analysis of Affine Term Structure Models," available in PostScript (approx 594K) and PDF (approx 874K) formats.

Keisuke Hirano, for the Harvard University thesis "Essays on the Econometric Analysis of Panel Data," available on his research papers site.

1998

Recipient:

Patrick L. Bajari, for the University of Minnesota thesis "The First Price Sealed Bid Auction with Asymmetric Bidders: Theory with Applications."

Honorable Mentions:

Tong Li, for the University of Southern California thesis "Affiliated Private Values in OCS Wildcat Auctions,"

Ahmet K. Tahmiscioglu, for the University of Southern California thesis "A Bayesian Analysis of Pooling Cross-Section and Time Series Data: An Investigation of Company Investment Behavior."

1997

Recipient:

Jeffrey Currie, for the University of Chicago thesis "The Geographic Extent of the Market: Theory and Application to U.S. Petroleum Markets."

Honorable Mentions:

Jason Abrevaya, for the MIT thesis "Semiparametric Estimation Methods for Nonlinear Panel Data Models and Mismeasured Dependent Variables,"

Stephen Gray, for the Stanford thesis "Essays in Financial Economics."

1996

Recipient:

Ekaterina Kyriazidou, for the Northwestern University thesis "Essays in Estimation and Testing of Econometric Models." available in PDF format (approx 1.22 Meg).

Honorable Mention:

Graham Elliot, for the Harvard University thesis "Application of Local to Unity Asymptotic Theory to Time Series Regression."

1995

Recipient:

Marjorie Rosenberg, for the University of Michigan thesis "A Hierarchical Bayesian Model of the Rate of Non-Acceptable In-patient Hospital Utilization.", which led to the paper "A Statistical Control Model for Utilization Management Programs", available in PDF format.

Honorable Mention:

Phillip Braun, for the University of Chicago thesis "Asset Pricing and Capital Investment."

1994

Recipient:

Geert Bekaert, for the Northwestern University thesis "Empirical Analysis of Foreign Exchange Markets: General Equilibrium Perspectives."

Honorable Mention:

Yacine Aït-Sahalia, for the MIT thesis "Nonparametric Functional Estimation with Applications to Financial Models," which includes material from the following papers: "Nonparametric Pricing of Interest Rate Derivative Structures," available in PDF format (approx 1.66 Meg) and "Testing Continuous Time Models of the Spot Interest Rate" available in PDF format (approx 1.66 Meg)

Subscribe to:

Posts (Atom)